INDUSTRY

- Finance

SERVICES

- Community & Content

- Service Design & Communication

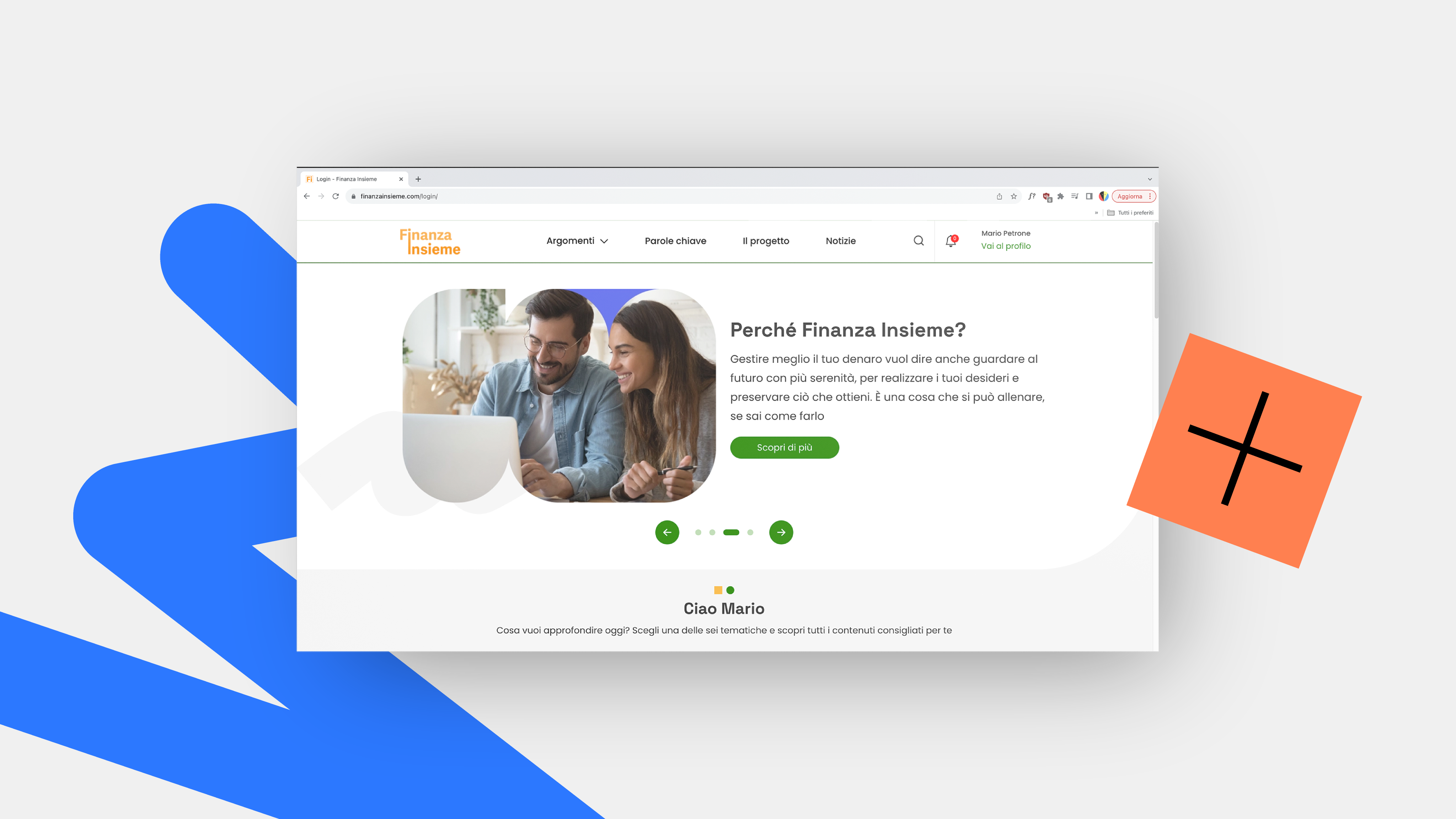

An innovative platform to train and develop financial awareness.

Making finance enjoyable, with authoritative content.

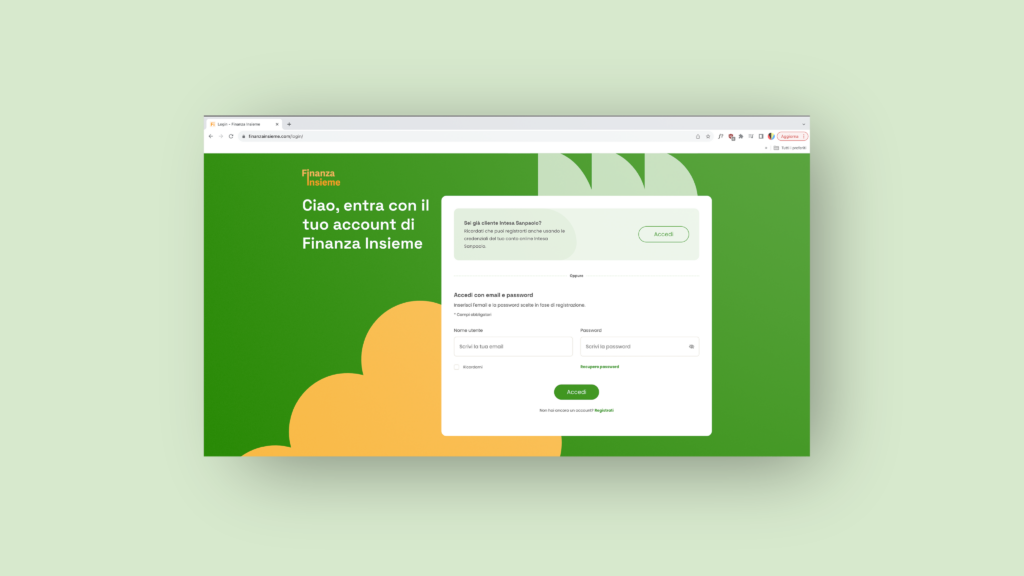

The risks associated with ‘financial fragility’ are becoming increasingly widespread, as highlighted by major national and international financial institutions. To counteract them and promote people’s financial well-being, it is necessary to act not only on their knowledge but also on the behavioral and emotional traits that guide them. The Intesa Sanpaolo Group, which has long been committed to improving people’s financial knowledge and making them more aware of their choices, has decided to launch a new initiative, promoted by Divisione Banca dei Territori.

The Logotel team, composed of professionals from various fields, has worked closely with Intesa Sanpaolo’s Direzione Studi e Ricerche and external experts from different disciplines and research areas – including demography, behavioral finance, anthropology, and the psychology of emotions – to address the multiple challenges of the project: from the difficulty of making complex financial topics enjoyable and engaging, to the need to provide authoritative content that could be interesting for the diverse audience of the platform, including individuals who are more literate in these subjects.

Content, exercises and tools for self-awareness and making informed decisions.

The initial phase of study, data collection, and needs understanding began in 2021 with a qualitative and quantitative survey involving a representative sample of over 1,000 people, with more than 1,400 hours of tests and simulations with both customers and non-customers. An international benchmark followed to understand how to position the project in an original and distinct manner compared to other financial education initiatives.

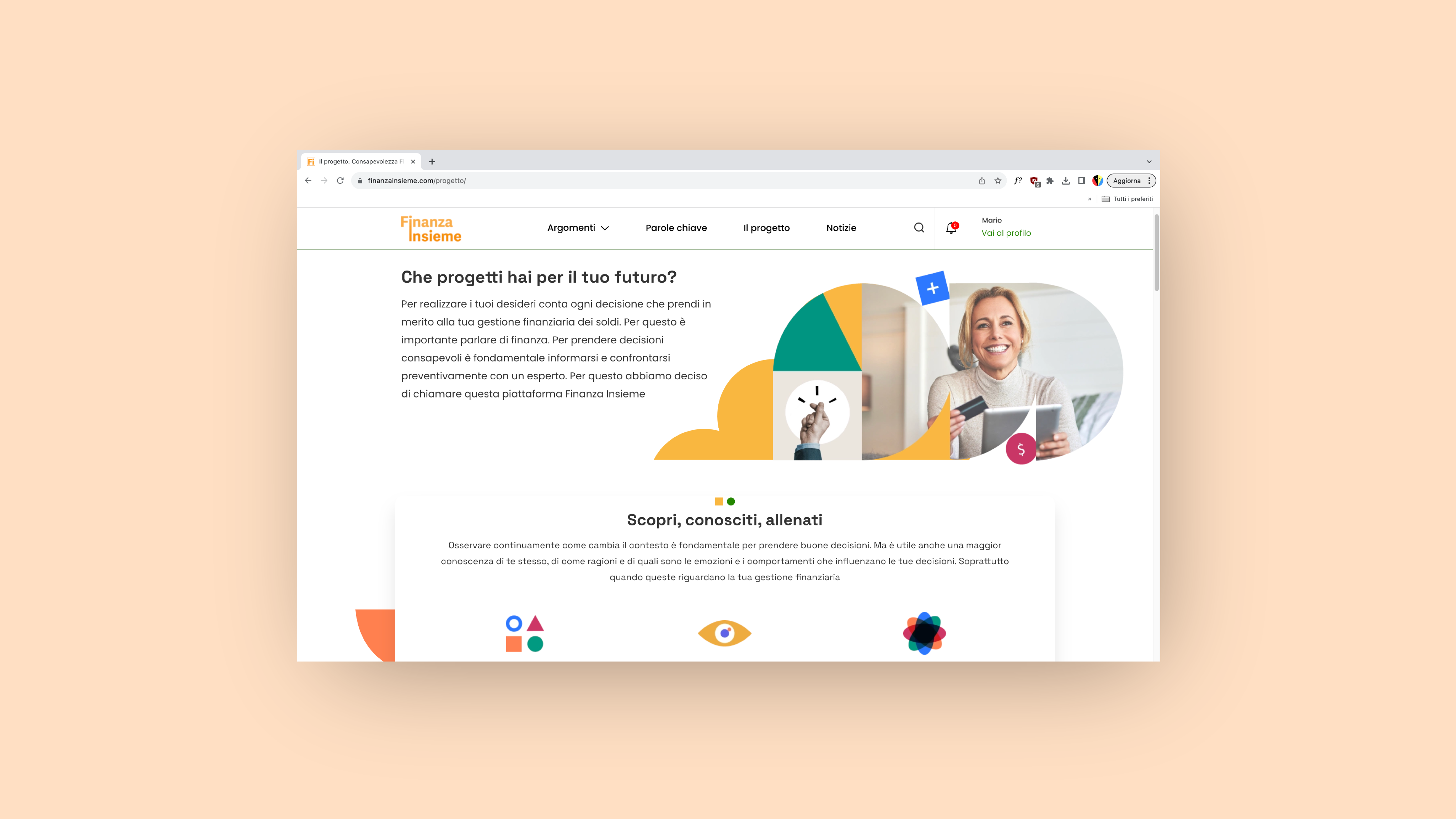

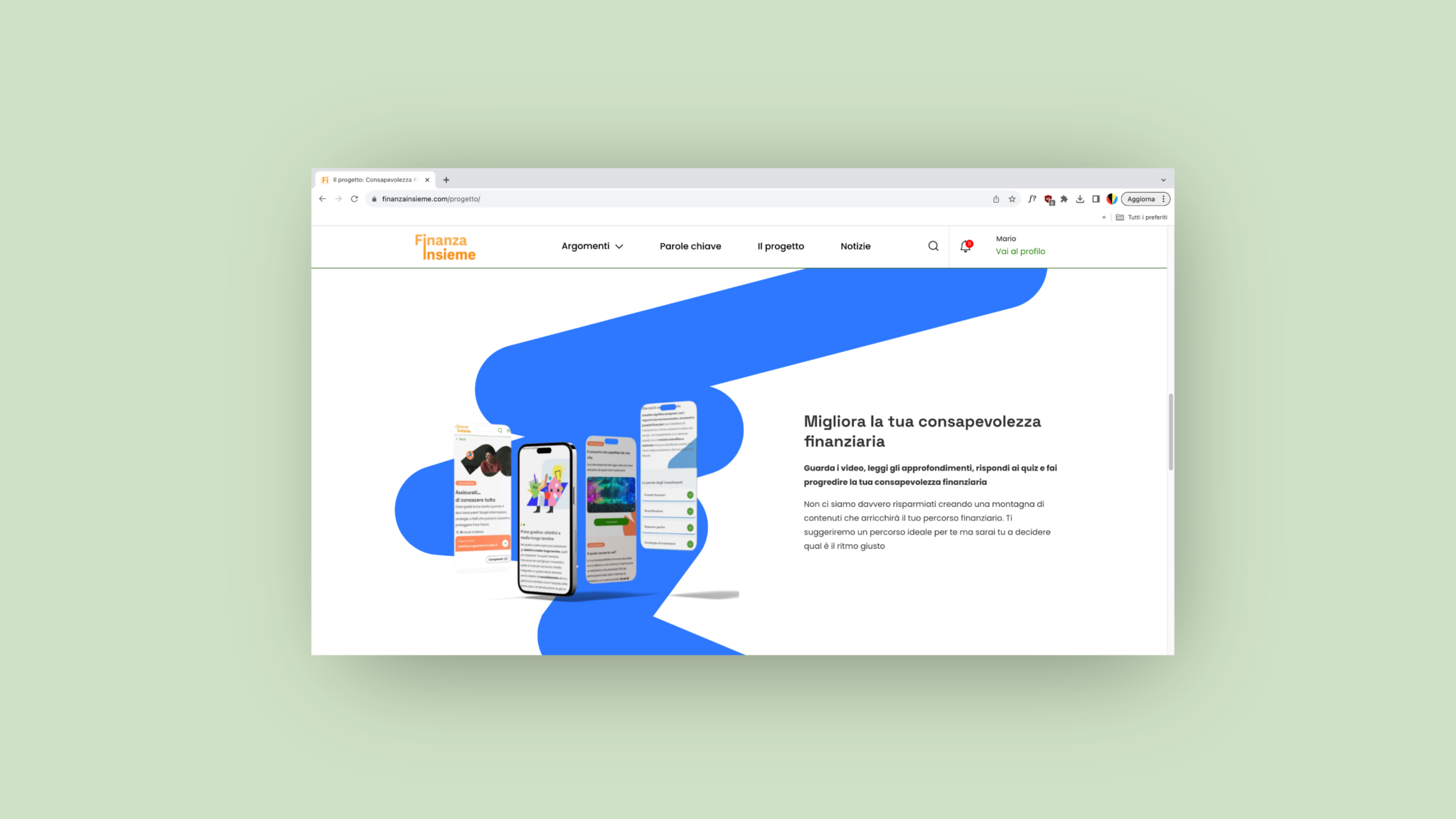

The solution was a platform focused on an anecdotal, everyday, and experiential approach to guide people, with clear language, in understanding how emotions and attitudes influence the financial choices they make. This part, more closely related to a behavioral approach, is complemented by a component more focused on knowledge, with technical and in-depth content. At every stage of the project, great attention was also given to ensuring that all the content provided was in compliance with OECD recommendations on financial literacy and fully accessible to all users.

A tailored, interactive, and dynamic experience.

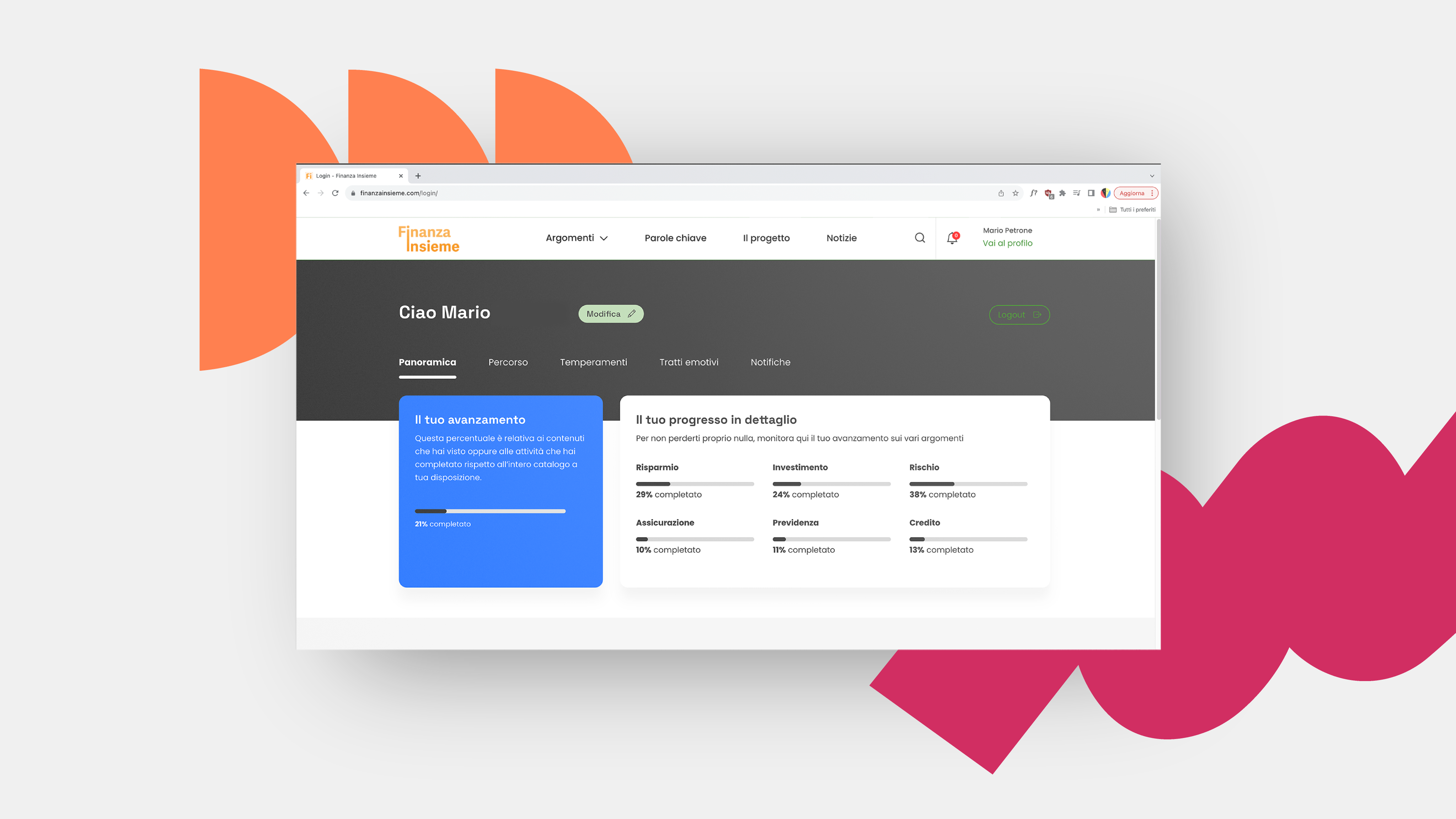

Finanza Insieme offers six different pathways, each focused on a specific area of need: savings, investments, risk, insurance, retirement, and credit. The multimedia contents – videos, quizzes –, exercises, and tools offered are divided into three strands: “to understand”, a section to decode the context and learn key fundamental terms; “to know oneself”, with micro-coaching activities that, through anecdotes and everyday situations, guide individuals to recognize the role of thoughts and emotions in their financial choices; “to practice”, with experiential and logical exercises useful for recognizing and overcoming various cognitive biases that influence our choices.

The platform guides individuals through a personalized, interactive, and dynamic experience that begins with an optional self-assessment test, helpful in capturing initial clues about temperaments and emotional traits that most influence their decision-making processes. Through qualitative indicators, individuals can measure their progress and tangibly observe improvements in their financial awareness.

Designing a thriving future for individuals and communities.

Finanza Insieme is a project aimed at the present and the future, with the goal of helping people design a more prosperous future for themselves and the community in which they live. For this reason, it will continue to be fueled with new content on current economic and financial topics, developed in collaboration with the Direzione Studi e Ricerche. These will help understand and experience how awareness of the emotions and attitudes that guide one’s choices is fundamental when it comes to money and beyond.

People involved in the initial phase

1000+

Hours of tests and simulations

1400+

Multimedia content

300+

Minutes of online experience

1500+